Check the credit limit on your CC is where you want it to be. Ask them where their associated ATMs are located in Vancouver and Seattle and Banff. Put a travel watch on your card - meaning let them know where you are going and when, so that ATM transactions will be green lighted for you. If you want to take out $700 at one time, make sure the bank sets this up for you. Go your bank to set your daily ATM debit card withdrawal limit to the amount you want it to be. Put your meals, car rentals and hotels on credit card (leave that part of your budget at home to pay for the bill when it arrives later) and take money out of ATMs as you go (for admissions, entrance fees, tips, snacks, vending machines, even surprises) in larger amounts to reduce the number of transaction fees. Get a chunk of Canadian $ before you leave the USA. I think you need to just simplify everything. You are going to Banff/Jasper, Vancouver and Seattle from NYC with 2 teen kids in mid of August for 2 weeks (8/14-8/28). Just to recap from one of your other posts. you'll find that on all their bank signage. Just to add to PHPR's excellent post above (Reply # 5) The Bank of Nova Scotia (BNS) in Canada these days goes by it's nickname Scotiabank. have you called them, to find out which ATM Network they are affiliated with? Those logos on the back of your card are going to be what you need to look for when using an ATM. Everything you need to know is in that article.Īnd lastly. (KRP's Reply # 8 above has excellent info).įor info on all things financial read the link to the CANADA - TRAVELLER ARTICLE on *Banks & Money* that my esteemed colleague RESCUE TEAM has provided above. added up I know that would be a lot more than 3%. Fees to purchase, and in some places fees to cash. and a day's worth would be able to carry you. we primarily tell Travellers just to carry some as a Financial Emergency Plan (in case something was to happen to all your Monies, if they got lost or stollen you could get them replaced a lot quicker than Plastic or Cash. Travellers Cheques are a HUGE hassle, and very uncommon nowadays. BUT the card isn't accepted everywhere like Visa or MasterCard. which is why we tell Travellers to take out a big chunk vs a lot of little ones (the $ 1.50 will be charged no matter how much you take out).ĪMEX (assuming you mean the Credit Card) is certainly lower at 2.7%. Anytime you are doing a face-to-face exchange, the fees are higher in order to cover salaries, time, paperwork, convenience / inconvenience etc.Ĭiti Bank's Fees are not unreasonable (3% + $ 1.50 ATM Fee). and that is generally speaking Plastic (Credit Cards or ATMs).

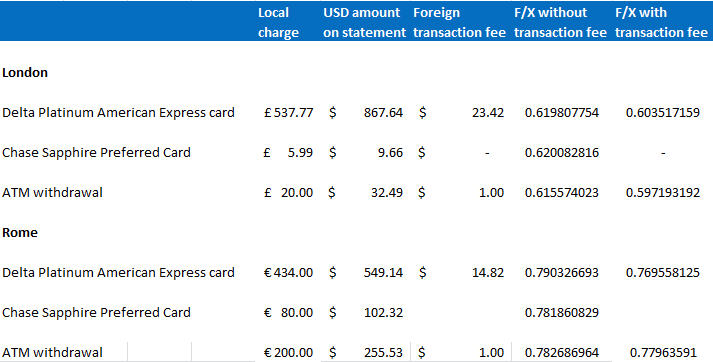

The trick is figuring out who has the lowest Fees. those who do the Conversion generally charge a fee (including Banks - Exchange Kiosks - and even Merchants). Based on the info that I've read from other Travellers to Canada, both of the Rates you've quoted are Excellent (YES there is a "cost" to converting money beyond just the Exchange Rate).

0 kommentar(er)

0 kommentar(er)